Why health care is a sticking point in shutdown negotiations

Clip: 9/29/2025 | 6m 16sVideo has Closed Captions

Why health care tax credits are a sticking point in shutdown negotiations

Millions of Americans who rely on health plans under the Affordable Care Act could see their premiums increase if Congress doesn’t expand key tax credits. Some could lose their insurance altogether. William Brangham discussed what this means for coverage and costs with Cynthia Cox of KFF.

Problems playing video? | Closed Captioning Feedback

Problems playing video? | Closed Captioning Feedback

Major corporate funding for the PBS News Hour is provided by BDO, BNSF, Consumer Cellular, American Cruise Lines, and Raymond James. Funding for the PBS NewsHour Weekend is provided by...

Why health care is a sticking point in shutdown negotiations

Clip: 9/29/2025 | 6m 16sVideo has Closed Captions

Millions of Americans who rely on health plans under the Affordable Care Act could see their premiums increase if Congress doesn’t expand key tax credits. Some could lose their insurance altogether. William Brangham discussed what this means for coverage and costs with Cynthia Cox of KFF.

Problems playing video? | Closed Captioning Feedback

How to Watch PBS News Hour

PBS News Hour is available to stream on pbs.org and the free PBS App, available on iPhone, Apple TV, Android TV, Android smartphones, Amazon Fire TV, Amazon Fire Tablet, Roku, Samsung Smart TV, and Vizio.

Providing Support for PBS.org

Learn Moreabout PBS online sponsorshipAMNA NAWAZ: Well, as we heard, millions of Americans who rely on health plans under the Affordable Care Act could see their premiums increase if Congress doesn't extend key tax credits, and some could lose their insurance altogether.

William Brangham has more on that part of the story.

WILLIAM BRANGHAM: Amna, these enhanced tax credits were expanded during the pandemic to make health insurance more affordable for people who buy ACA, or Obamacare, plans.

More than 20 million people enrolled in marketplace plans in 2024, which is a record high.

And most of them received these credits.

The credits were set to expire at the end of, 2022 but were then extended as part of the Inflation Reduction Act.

So, for more on what this means for health care in America and what it costs, I'm joined by Cynthia Cox.

She's vice president and director for the Program on the ACA at KFF.

Cynthia Cox, thank you so much for being here.

We still don't know what's going to happen with these negotiations, but let's say that these tax credits are not extended.

And open enrollment begins very, very soon.

What is likely to happen?

CYNTHIA COX, Program on the ACA Director, KFF: What will happen if these enhanced premium tax credits are not extended by Congress is that millions of people are going to log on to healthcare.gov or their state's marketplace, and they're going to see that their premiums for next year are doubling.

On average, we're expecting people to pay about twice as much as they're currently paying for health insurance if they want to keep the same plan.

They might be able to get a lower-cost plan or pay a little bit less than what they otherwise would have to pay, but that might mean getting a deductible that's several thousand dollars.

WILLIAM BRANGHAM: And do we have a sense of how many people could see those staggeringly high increases in their premiums and sort of what slice of the population that might be?

CYNTHIA COX: So what we're looking at are people who buy their own health insurance coverage.

This is not really going to affect people like me or you or many other people who get their insurance through work.

This is really small business owners, farmers and ranchers, other people who work at small companies that don't offer health insurance.

And so, for them, they're buying their own insurance and getting a tax credit to help with the cost.

What we're expecting is that -- about 22 million people are getting one of these enhanced tax credits right now, and their premium costs would double on average or more maybe.

And so this could mean that they have to, say, make a change to their employment and get a different job that does offer health insurance if they can't afford to continue paying for their own insurance or they might become uninsured if they just aren't able to afford to continue that coverage.

WILLIAM BRANGHAM: And we know, once people become uninsured, it's not like then they stop getting sick or stop having accidents, that the downstream ripple effects could be enormous if millions of people suddenly lose their insurance.

CYNTHIA COX: That's right.

And so this is already having an effect on insurance markets.

Some insurers are charging even higher premiums for next year because they think that healthier people are going to drop out of the insurance market.

And hospitals are also concerned.

So they're thinking, well, if more people show up to the emergency room who are uninsured, the hospital still has to pay for their care and stabilize them.

So they're concerned that there might have an increase in the number of people who aren't able to pay for their hospitalization.

That might mean that some hospitals, particularly in rural areas, where they're already struggling, might have to close.

WILLIAM BRANGHAM: Republicans have argued that these tax credits are too costly, that the -- that some people are earning too much money and ought not to receive them, and that this was enacted during the pandemic as a pandemic measure and the pandemic is over.

And I wonder, just from a public policy perspective, what do you make of those arguments?

CYNTHIA COX: So it is true that the tax credits are expensive.

It would cost about $35 billion per year with taxpayer money to extend these enhanced tax credits.

Now, that's really because health insurance is really expensive in the United States.

So making it possible for lower-income and middle-income people to afford to pay for health insurance means that they will need financial help to do so.

And so that's really the trade-off here, is, are people going to be able to afford their insurance, in which case they would need financial help to do so, or is the cost just too much to the federal government?

So most of the people getting these enhanced tax credits are actually very low-income people who live in Southern red states.

Texas, Florida and Georgia account for most of the growth that we're seeing in the marketplaces right now.

But there's also higher-income people who qualify.

That might be, say, a small business owner who otherwise might have to pay 10, 15 or even 20 percent of their income for health insurance just because health insurance is so expensive.

But these enhanced tax credits cap how much they have to pay at about 8.5 percent of their income.

WILLIAM BRANGHAM: Is there any legislative fix that could address some of these issues with the ACA, assuming these tax credits go away?

CYNTHIA COX: There are a few different critiques of the Affordable Care Act.

I think one is that health insurance, private health insurance, is expensive.

Now, the health insurance is being sold through the Obamacare markets is no more expensive than the health insurance that employers buy and provide to their employees.

It's just that the employer is paying for a large share of that cost and the employee is paying less.

And so when people go on to buy their own health insurance, they often will get sticker shock to see, wow, this is how much health insurance costs.

Well, yes, that's how much it costs.

And that's because health care is just really expensive in the United States.

And so if you want to make health insurance less expensive, then the ways to do that are either to subsidize it with taxpayer dollars or to address the underlying reasons why health care is so expensive.

But that might mean paying hospitals less, paying doctors less.

And that's maybe not as politically popular as subsidizing health insurance.

WILLIAM BRANGHAM: All right, that is Cynthia Cox, vice president of KFF.

Cynthia, thank you so much for your time.

CYNTHIA COX: OK.

Thank you.

Government shutdown appears unavoidable

Video has Closed Captions

Clip: 9/29/2025 | 5m 58s | Government shutdown appears unavoidable after White House meeting fails to produce deal (5m 58s)

How artists and musicians are responding to Trump's 2nd term

Video has Closed Captions

Clip: 9/29/2025 | 9m 19s | How artists and musicians are responding to Trump's 2nd term (9m 19s)

In aftermath of church attack, investigators seek motive

Video has Closed Captions

Clip: 9/29/2025 | 3m 15s | In aftermath of Michigan LDS church attack, investigators seek gunman's motive (3m 15s)

Mideast experts analyze viability of Gaza peace proposal

Video has Closed Captions

Clip: 9/29/2025 | 7m 45s | Mideast experts analyze viability of Gaza peace proposal (7m 45s)

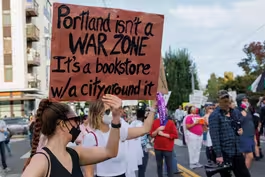

News Wrap: Pentagon sending National Guard to Portland

Video has Closed Captions

Clip: 9/29/2025 | 6m 19s | News Wrap: Pentagon confirms plans to send 200 National Guard members to Portland (6m 19s)

Tamara Keith and Amy Walter on how Democrats are negotiating

Video has Closed Captions

Clip: 9/29/2025 | 7m 17s | Tamara Keith and Amy Walter on Democrats' approach to negotiations with Trump (7m 17s)

What's in the Trump-Netanyahu proposal to end the Gaza war

Video has Closed Captions

Clip: 9/29/2025 | 5m 34s | What's in the plan to end the Gaza war proposed by Trump and Netanyahu (5m 34s)

Providing Support for PBS.org

Learn Moreabout PBS online sponsorship

- News and Public Affairs

FRONTLINE is investigative journalism that questions, explains and changes our world.

- News and Public Affairs

Amanpour and Company features conversations with leaders and decision makers.

Support for PBS provided by:

Major corporate funding for the PBS News Hour is provided by BDO, BNSF, Consumer Cellular, American Cruise Lines, and Raymond James. Funding for the PBS NewsHour Weekend is provided by...