NJ Spotlight News

Reitmeyer-interview

Clip: 8/17/2023 | 4m 26sVideo has Closed Captions

Many eligible homeowners and renters should see a second benefit payment in 2023.

Many eligible homeowners and renters under the state's "Anchor" program should see a second benefit payment in 2023. While it’s likely welcome news, some critics are calling into question the timing of the payments in an election year. NJ Spotlight News reporter John Reitmeyer shares more.

Problems playing video? | Closed Captioning Feedback

Problems playing video? | Closed Captioning Feedback

NJ Spotlight News is a local public television program presented by THIRTEEN PBS

NJ Spotlight News

Reitmeyer-interview

Clip: 8/17/2023 | 4m 26sVideo has Closed Captions

Many eligible homeowners and renters under the state's "Anchor" program should see a second benefit payment in 2023. While it’s likely welcome news, some critics are calling into question the timing of the payments in an election year. NJ Spotlight News reporter John Reitmeyer shares more.

Problems playing video? | Closed Captioning Feedback

How to Watch NJ Spotlight News

NJ Spotlight News is available to stream on pbs.org and the free PBS App, available on iPhone, Apple TV, Android TV, Android smartphones, Amazon Fire TV, Amazon Fire Tablet, Roku, Samsung Smart TV, and Vizio.

Providing Support for PBS.org

Learn Moreabout PBS online sponsorshipIn our Spotlight on Business Report.

If you received a property tax rebate this spring through the state's Anchor program, you should keep an eye on the mailbox this fall.

The Murphy administration says the roughly 1.3 million renters and homeowners who initially qualified will automatically be re-enrolled for the rebates and it could be as high as 1700 bucks.

Now, while it's likely welcome news, some critics are calling into question the timing of the payments.

For more, I'm joined by budget and finance writer John Reitmeyer.

Hey, John, good to see you.

So let's talk first about the fact that now you no longer have to apply for this rebate.

That's kind of a big deal.

It is for.

There are two groups here, really for more than a million, more than 1 million people.

You don't have to apply.

You're going to be automatically enrolled in this next phase of payments based on your participation in the first phase that occurred earlier this year.

So that's one group.

There's another group of people who may be newly eligible or for some other reason.

They meet the standards and didn't participate.

A bunch of applications are going to be going up this month to to those people.

Some 2 million people in all are going to be getting applications.

And so they'll be able to jump into Anchor as well.

But there's that big group that's already been participating.

They're automatically enrolled and they'll be getting letters this month to indicate to confirm their automatic enrollment and give them an opportunity to change any key information.

So like Anchor comes as a check or a direct deposit.

If you need to change your bank account information or anything like that.

You have to do that by September 30th.

Everyone else who gets the application has to get that in by December 29.

But this is important because now, I mean, folks potentially are getting two checks.

Previous programs, it was taken off of your property tax bill.

This is, you know, cash in your hands.

And not just that, but twice in one year.

So is this a political move?

Is this because the state is just flush with money right now?

Yes, I think it's probably partly both things, right.

This the state budget that was enacted at the end of June, the new fiscal year budget included $2 billion for Anchor.

A very big number for this direct property tax relief program.

The state also had a very big surplus.

And so the timing of this, you know, usually these types of things used to happen in the spring because the state collects a lot of money and income tax payments in the spring and then would fund these types of benefits.

But now the state has a lot of money on hand And so they're moving up the timeline.

But also, we can't be ignorant of the fact that an election is coming, an election with all 120 legislators on the ballot.

Absolutely.

And, you know, lawmakers love if you remember, just two years ago, there was a one time income tax, up to $500 check that went out to many New Jersey families that also arrived just before the election.

So there's a long history of these types of election year sweeteners.

And so it works out that it works from a budgeting perspective this year.

But also lines up very nicely with the election cycle if you're an incumbent lawmaker.

Yeah.

I mean, I read I'm sure you did as well statements from folks like Republican Mike Testa, others who are likening the Murphy administration and other Democrats with, you know, Santa Claus handing out these checks.

I mean, how much does that play into voters' minds when they head to the poll and they've just gotten another check in the mail?

I think it can't hurt.

And we just saw some poll data that's that indicates the approval rating for the legislature is pretty low.

And some questions about how Governor Murphy has handled the issue of property taxes.

And so I'm sure it can't hurt.

One quick thing to note, the new budget that was enacted has what's known as a structural deficit.

So the state's going to collect less from taxpayers than it will spend over the fiscal year.

And so when you're spending $2 billion on property tax relief, you know, that's all part of the equation as well.

And quickly, there has been some talk also about how long this Anchor program can sustain.

What do we know about that so far?

It's going to go as the economy goes.

The income tax funds, this one, income tax receipts are flush.

There will be plenty of money for things like this.

The real test will will be when we see a recession we see unemployment tick up and maybe we see wages fall.

That will be the test because it is funded with income tax receipts.

All right.

John Reitmeyer for us, thanks as always, John.

You're welcome.

Camden City School District works to boost pre-K enrollment

Video has Closed Captions

Clip: 8/17/2023 | 4m 6s | Enrollment declined during the COVID-19 pandemic (4m 6s)

Federal appeals court rules to limit access to abortion pill

Video has Closed Captions

Clip: 8/17/2023 | 5m 29s | The ruling will not go into effect pending final Supreme Court decision (5m 29s)

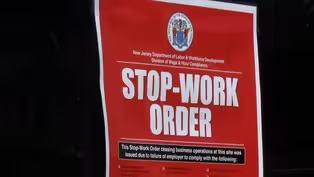

NJ shuts down 27 Boston Market locations

Video has Closed Captions

Clip: 8/17/2023 | 3m | State labor department issued stop-work orders for violations of workers' rights (3m)

Suspect indicted in Sayreville councilwoman’s murder

Video has Closed Captions

Clip: 8/17/2023 | 58s | Eunice Dwumfour was shot and killed in her car in February (58s)

Underage tobacco sales common, critics blame lax enforcement

Video has Closed Captions

Clip: 8/17/2023 | 4m 19s | Of underage tobacco sales, 64% were menthol cigarettes, according to poll (4m 19s)

Providing Support for PBS.org

Learn Moreabout PBS online sponsorshipSupport for PBS provided by:

NJ Spotlight News is a local public television program presented by THIRTEEN PBS